vermont department of taxes forms

Information about updating registration or title after the death of the owner. 802 828-2301 Toll Free.

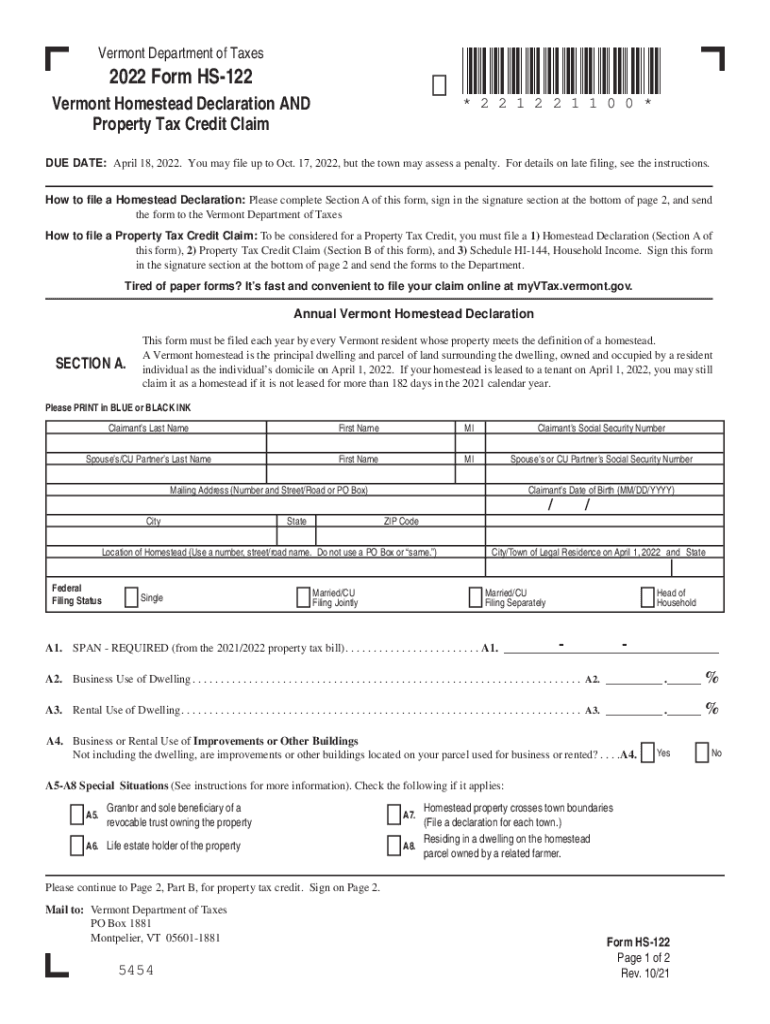

2022 Vt Form Hs 122 Fill Online Printable Fillable Blank Pdffiller

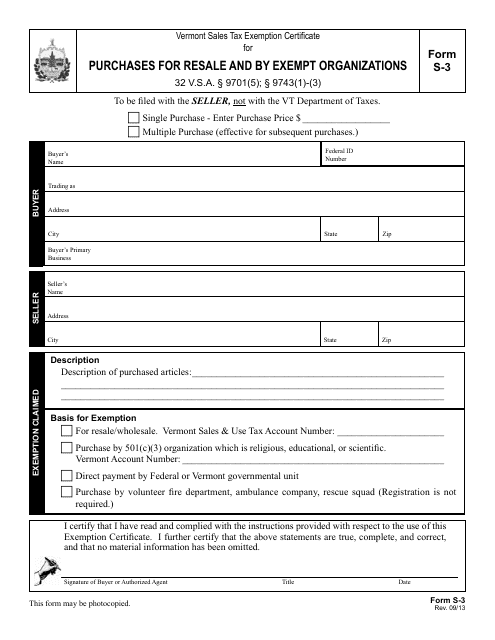

Exemption Organization Registration Certificate for ont Sales and Use Tax Verma letter from the.

. DUE DATE April 15 2020. Copy of. You may also submit your request by email or fax.

Vermont Department of Taxes. Vermont Income Tax Return. Every January the Vermont Department of Labor sends 1099-G forms to individuals who received unemployment insurance benefits during the prior calendar year.

Department of Taxes. An Official Vermont Government Website. The Department has worked to ensure information was correct to the best of its ability.

Estates Trusts and the. PUBLIC INFORMATION REQUESTS TO. PR-141 HI-144 2020 Instructions 2020 Renter Rebate Claim.

Please include your full name company name if applicable mailing address form name or number tax year and quantity of each telephone number and email address optional. More about the Vermont Form IN-111 Tax Return. Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes.

The gov means its official. Electronic Transfer of W-2 1099 and WH-434 Filings. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers.

Please mail your written request to. We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government. PA-1 Special Power of Attorney.

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. To order DMV stickers forms manuals and other supplies by licensed Vermont Dealers. Understand and comply with their state tax obligations.

Vermont Department of Labor 5 Green Mountain Drive PO. However if information on-file was provided incorrectly or if claimants have moved or changed their names 2021 Unemployment Insurance Claimants may request corrections to their 1099-G tax form additional copies of their new 1099-G or report receiving a 1099-G due to suspected fraud. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Use a vermont state tax form 2020 template to make your document workflow more streamlined. Please refer to your assessment letter for the correct contact information or see our FAQs on how to respond to. Use myVTax the departments online portal to e-file and submit Form PTT-172 Property Transfer Tax Return with the Department of Taxes and the municipality with a single service.

C-147 Employer Quarterly Wage Report Insturctions. For more information on 1099-G tax forms visit the Departments website for frequently asked questions information on programs and benefit codes how unemployment insurance benefits are calculated more. Individual Income Tax Filing.

File a Property Transfer Tax Return Vermontgov. Vermonters who received unemployment benefits in 2021 will need the information on the 1099-G to complete their annual income tax. Corporate and Business Income.

You or your representative must sign the request for an appeal and mail or deliver the request to. Department of Taxes. C-102 Employers Amended Quarterly Report Form.

Commercial Vehicles CVO Enforcement. IN-111 Vermont Income Tax Return. Copies of the IRS form letters 1045 and 1050 indicating that youre eligible as a 501c3 organization.

Box 488 Montpelier 05601-0488 802 828-4000. Vermont has a state income tax that ranges between 3350 and 8750. 15 2020 but the town may assess a penalty.

The current tax year is 2021 with tax returns due in April 2022. Vermont Department of Labor 5 Green Mountain Drive PO. TaxFormFinder provides printable PDF copies of 52 current Vermont income tax forms.

For details on late filing see the instructions. 273 rows Dealer Renewal Packet - includes DMV forms VD-006 VD-008 VD-114 VD-114a. Box 488 Montpelier 05601-0488 802 828-4000.

You may file up to Oct. The 1099-G is a tax form for certain government payments. Accepted for tax year 2021 homestead declaration and property tax credit filing.

To purchase Virginia Package X copies of annual forms complete and mail the Package X Order Form. Vermont Department of Taxes. Most states will release updated tax forms between January and April.

If you received Form 1099-G for unemployment compensation from the Vermont Department of Labor and have questions please review information on the Department of Labors website. Department of Taxes signed by the Tax Department stating that the organization has been granted exemption status. Department of Taxes The eCuse system allows property owners to submit online applications to the Current Use Program and allows town clerks assistant town clerks and listers to view Current Use applications.

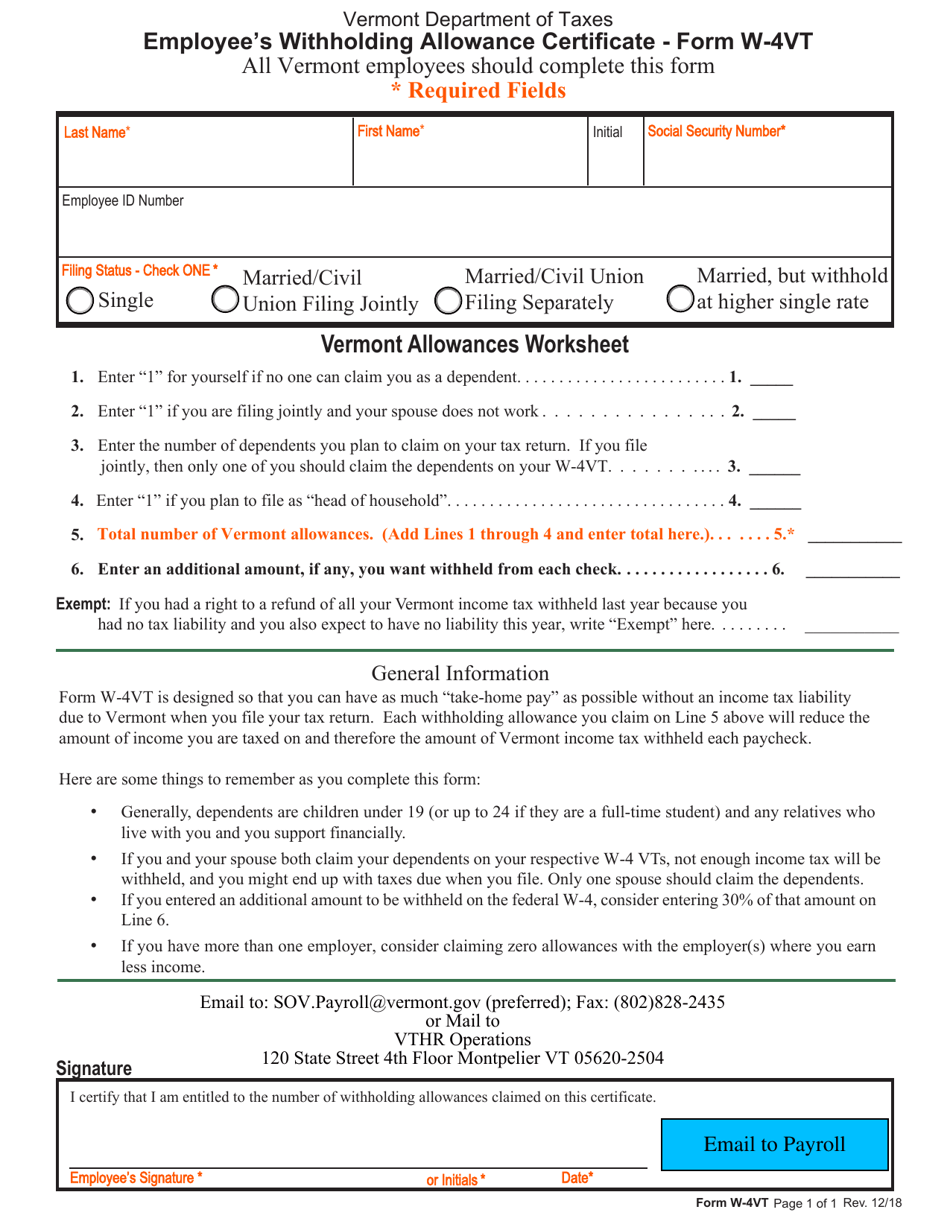

Tax Tables 2020 2020 Vermont Tax Tables. W-4VT Employees Withholding Allowance Certificate. 2020 Form PVR-4404-ON Official Notice Decision of Board of Civil Authority.

LC-142 2020 Instructions 2020 File your Landlord Certificate Form LC-142 online using myVTax or review the online filing instructions. To record dealer vehicle exchanges and transactions completed by the dealer. Department of Taxes Payroll companies and employers should Use myVTax.

Vermont Department of Motor Vehicles 120 State Street Montpelier VT 05603-0001. We last updated Vermont Form IN-111 in February 2022 from the Vermont Department of Taxes. C-104 Vermont Internet Tax.

Tax Year 2021 Form HSD-316 Request For Listers Certificate of Housesite Value For A Subdivided Parcel. PA-1 Special Power of Attorney. W-4VT Employees Withholding Allowance Certificate.

Office of the State Treasurer 109 State Street Montpelier Vermont 05609 Main Phone. 2019 Instructions LGT.

Vermont Tax Forms And Instructions For 2021 Form In 111

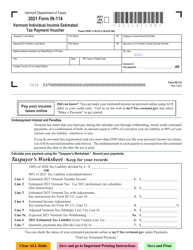

Vt Form In 114 Download Fillable Pdf Or Fill Online Vermont Individual Income Estimated Tax Payment Voucher 2021 Vermont Templateroller

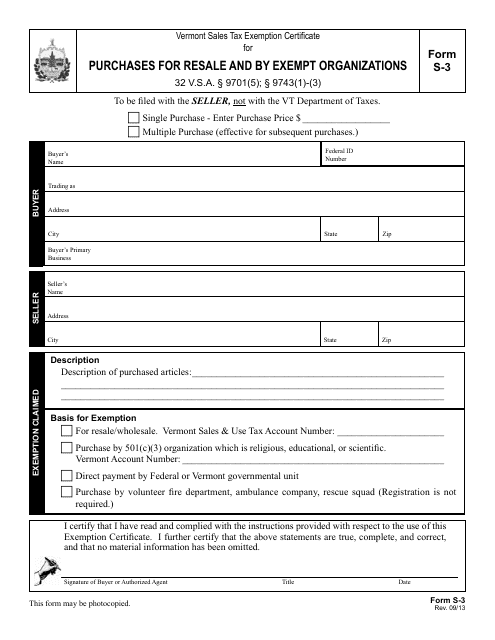

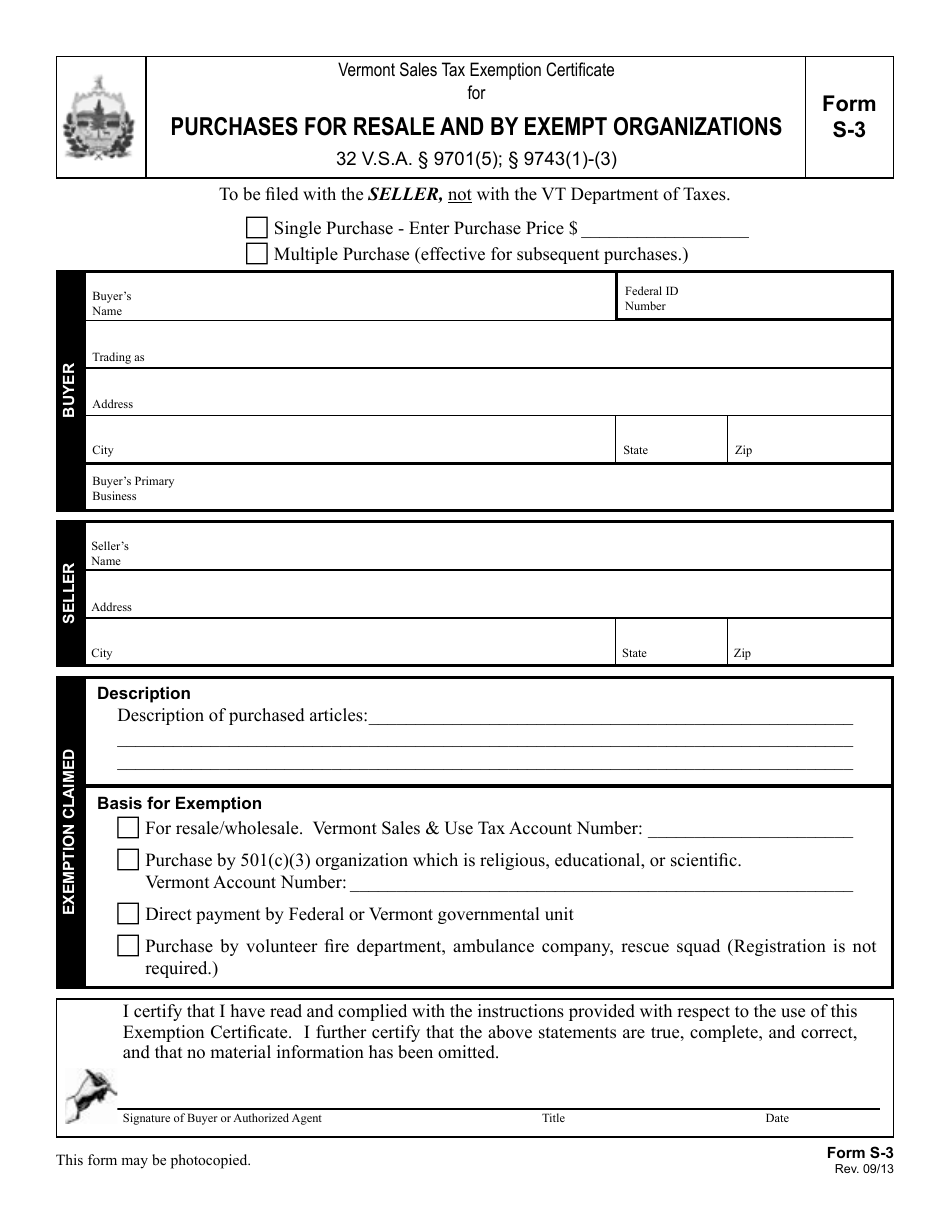

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

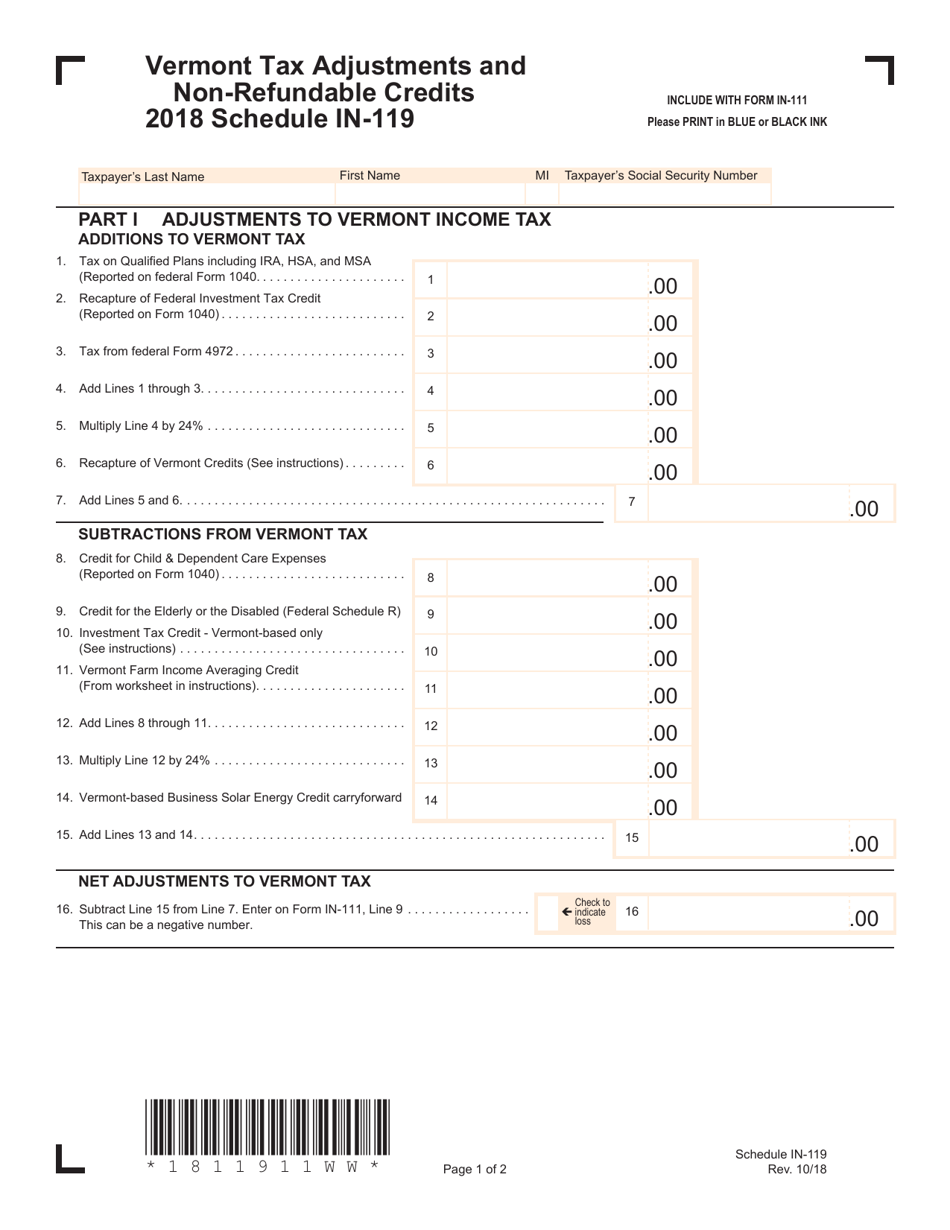

Schedule In 119 Download Fillable Pdf Or Fill Online Vermont Tax Adjustments And Non Refundable Credits 2018 Vermont Templateroller

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

U S Tax Refunds Down Nearly 9 Percent Vs Year Ago Irs Data Irs Tax Forms Tax Return Irs Forms

Tax Year 2021 Personal Income Tax Forms Department Of Taxes

Publications Department Of Taxes

Tax Year 2021 Personal Income Tax Forms Department Of Taxes

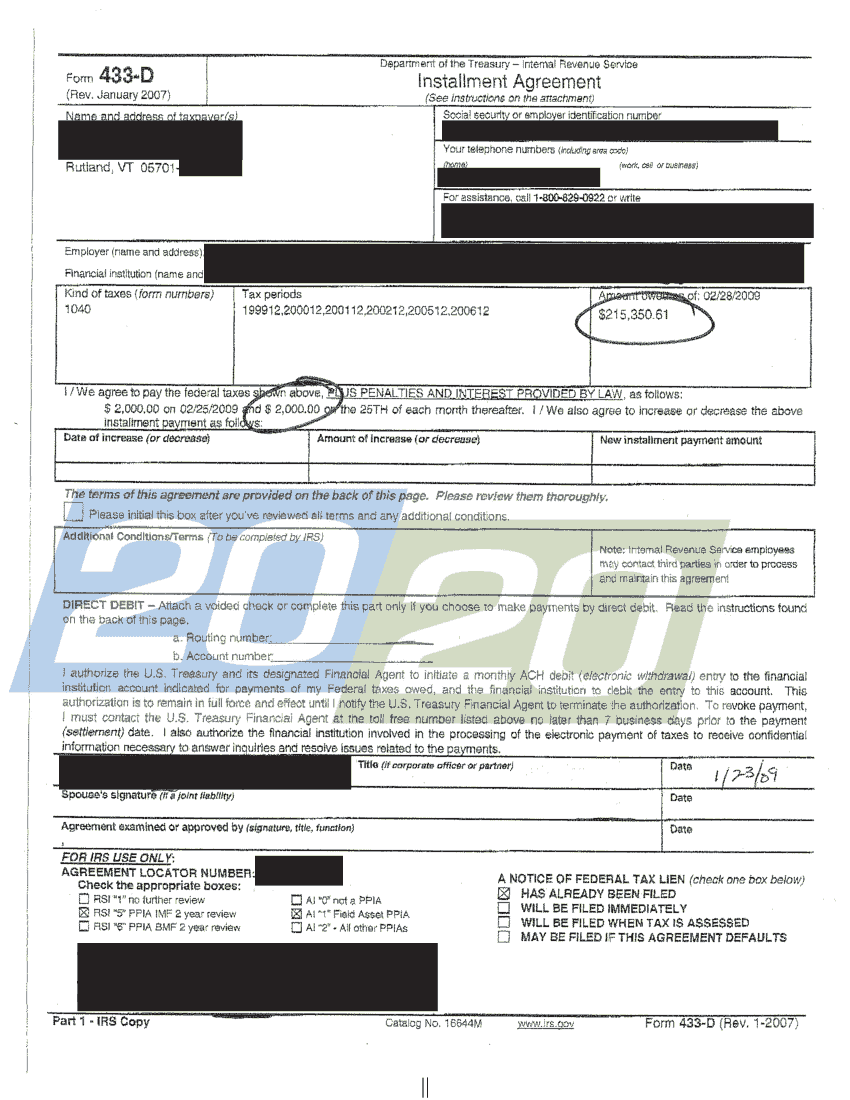

Successful Tax Resolutions In Vermont 20 20 Tax Resolution

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes